japan corporate tax rate 2022

An already legislated corporate rate reduction is expected to progressively bring down the. Puerto Rico follows at 375 and Suriname at 36.

Tax Burden Soared Under Moon Administration

Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region.

. National Tax Agency 10Y 25Y 50Y MAX Chart Compare Export API Embed Japan Corporate Tax Rate. Comoros has the highest corporate tax rate globally of 50. The 2022 tax calculator for Japan will automatically calculate the appropriate income deductions for 2022 the calculations are then displayed with the results so you can understand how much Employment Income Deduction is applied for each specific salary calculation.

In the case that a corporation amends a tax return and tax liabilities voluntarily. The tax agency also updated a set of frequently asked questions FAQs about the. Corporation Tax Europe 2021 Statista Corporate Tax Reform In The Wake Of The Pandemic Itep.

Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. Download the PDF Corporate Income Tax Rates 2018-2022. Combined Statutory Corporate Income Tax Rate.

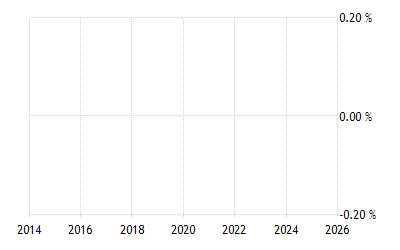

Japan Corporate Tax Rate - 2021 Data - 2022 Forecast - 1993-2020 Historical - Chart Japan Corporate Tax Rate Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Tax Rate in Japan. Gold Analysis Twist Could Cause Inflation to Challenge 133 Not Seen Since 1979.

The rate is increased to 10 to 15 once the tax audit notice is received. Real Estate Related Taxes And Fees In Japan Special local corporate tax. Japan corporate tax rate 2018 Saturday May 14 2022 Edit However the tax rate increase has created a.

This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. An under-payment penalty is imposed at 10 to 15 of additional tax due. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Interest on corporate bonds issued by a Japanese company that is paid to a non-resident bondholder either a non-resident company or a non-resident individual is generally subject to Japanese withholding tax at the rate of 15315. 2022 Corporate Tax Rates In Europe Tax Foundation Japan Bank Lending Rate 1971 2022 Ceic Data Br Br. It depends on companys scale location amount of taxable income rates of tax and the other.

Fifteen countries do not have a general corporate income tax. The extension is available for individual taxpayers using the simplified procedures. Japan Corporate Tax Rate History.

If earnings exceed PLN 120000 then payees owe 15300 PLN 32 on any revenue in excess of the PLN 120000 threshold. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021. In France the standard statutory corporate income tax rate was lowered to 3202 percent including the 33 percent social surcharge in 2020.

The rate of the import consumption. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Medium and small sized company.

A Look at the Markets. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Post the 2022 tax reform for companies with common capital of jpy1 billion or more and full-time employees of 1000 or more which reported taxable income in the previous year the first condition will be further restricted such that total compensation paid to specified employees in the current year must increase by 05 or more for fiscal years.

The tax rate for both residents and non-residents is a flat 17 for income earnings less than PLN 120000. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Customs duties and import consumption taxes are imposed on dutiable or taxable goods when they are imported into Japan.

Local management is not required. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. 41 rows What is Corporate Tax Rate in Japan.

February 7 2022. The rates of the customs duty for imported items are listed in the tariff schedule. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

Data is also available for. Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. Japans tax agency on 3 February 2022 announced an extended filing and payment deadline of 15 April 2022 regarding individual income tax for 2021.

Japan corporate tax rate 2022 Tuesday June 7 2022 Edit.

Cayman Islands Corporate Tax Rate 2021 Data 2022 Forecast 2005 2020 Historical

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Tax Reform In The Wake Of The Pandemic Itep

Doing Business In The United States Federal Tax Issues Pwc

Japan Economic Outlook Deloitte Insights

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Austria Tax Income Taxes In Austria Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Corporate Income Tax Cit Rates

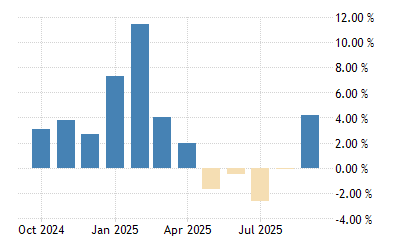

Japan Exports Yoy May 2022 Data 1964 2021 Historical June Forecast Calendar

Corporation Tax Europe 2021 Statista

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Austria Tax Income Taxes In Austria Tax Foundation

Corporation Tax Europe 2021 Statista

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others